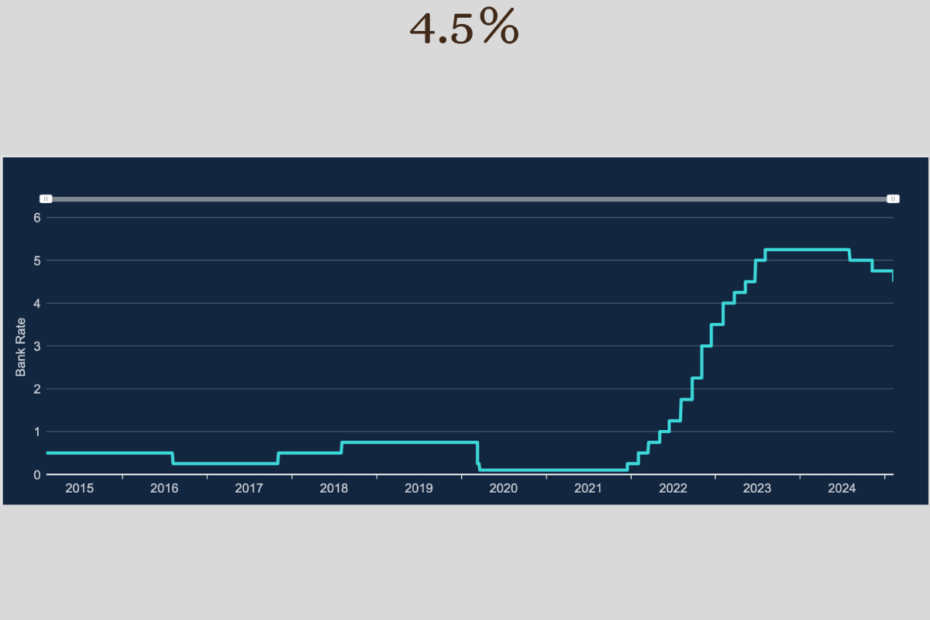

Today the Bank of England has announced a 0.25% cut to the base rate, bringing it down from 4.75% to 4.5%—the lowest since June 2023. While this move is designed to support the economy, its impact will feel very different depending on where you stand as a homeowner, landlord, or investor.

Why Has the Bank Cut Rates?

Several factors influenced this decision:

Slowing Economy – Growth forecasts for 2025 have been halved to 0.75%, signaling economic stagnation.

Falling Inflation – Inflation eased from 2.6% to 2.5% in December, surprising analysts who expected an increase.

With these challenges in mind, the Bank’s move aims to encourage borrowing and investment.

What Does This Mean for Homeowners and Buyers?

For those on tracker or variable-rate mortgages, this cut could mean slightly lower monthly payments. If you’re on a fixed-rate mortgage, there’s no immediate change—but if your fixed period is ending soon, things could look very different.

Many homeowners who locked in ultra-low rates years ago are now facing the reality of their mortgage rate jumping from 1% to 4.5% or more. For some, this could mean significantly higher repayments—something that can be a real strain, whether it’s a family home or a rental property.

Landlords and Investors—A Mixed Picture

For landlords, mortgage costs have been a major challenge over the past couple of years. A 0.25% cut is a step in the right direction, but for those with interest-only mortgages, the real concern is how much rates have already risen. If rental income doesn’t cover the new mortgage costs, tough decisions may need to be made.

Considering Your Next Move?

If you’re looking ahead and thinking about your options—perhaps before a fixed rate expires or just after—it’s worth knowing what choices are available. Every situation is different, but understanding your options early can make all the difference. If you’re in this position and want to explore the best way forward, feel free to reach out.

What’s Next?

The big question is whether this is just a one-off cut or the start of a downward trend. If inflation continues to ease, we could see further reductions later in the year.

For now, whether you’re a homeowner, investor, or landlord, staying informed is key. If you’re weighing up your next steps, let’s have a conversation—sometimes just talking through the possibilities can bring clarity.